What comes next in retail?

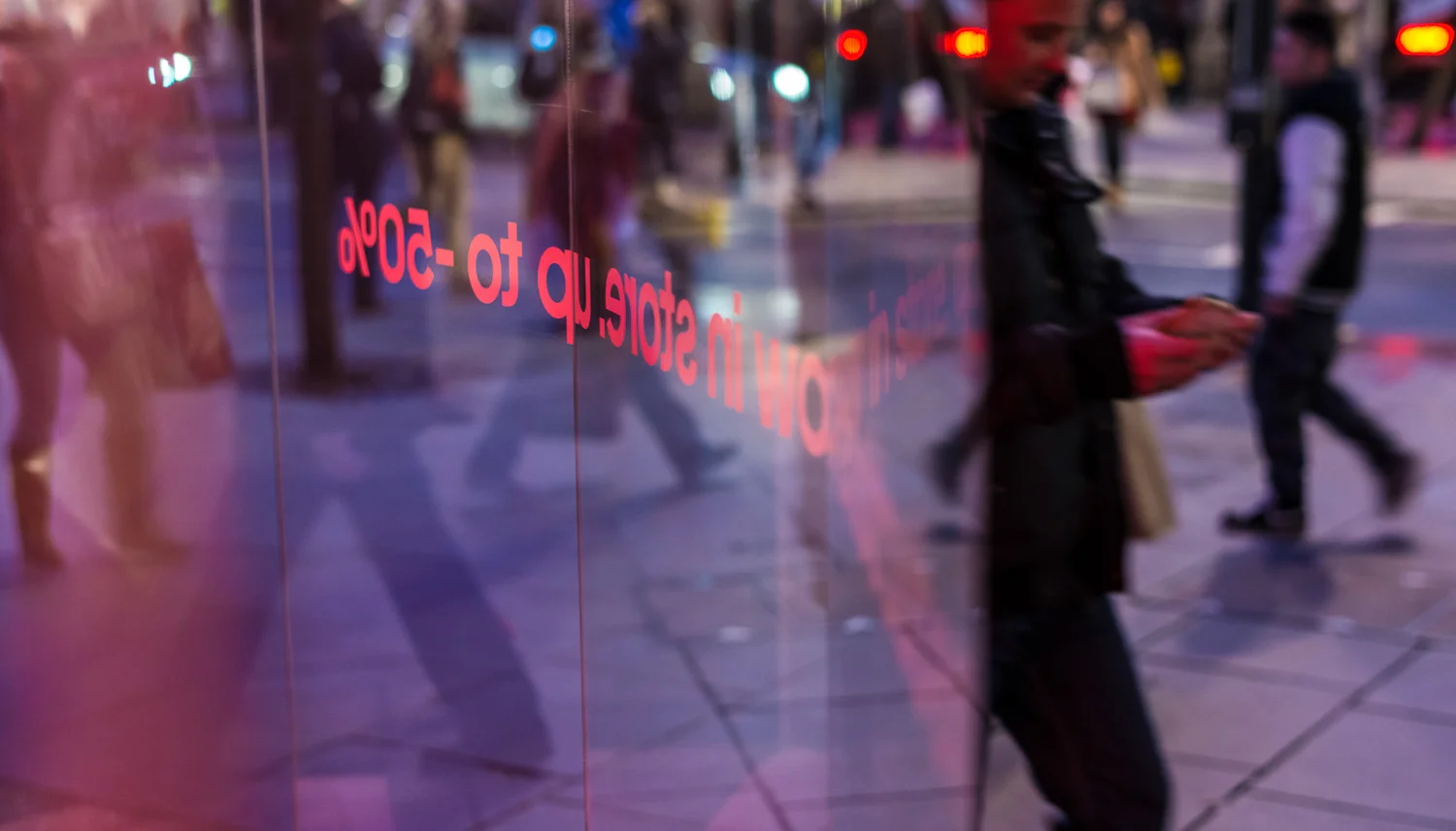

As more UK stores open after lockdown, many with trepidation, what kind of future is there for the high street?

It’s certainly not helpful to attempt detailed predictions but we can be sure of a few things:

Social distancing will be in place for many months to come, perhaps even longer. These restrictions, even when executed well, still make physical shopping less convenient for customers.

Post covid health measures will impact margin for many retailers, with reduced footfall and a requirement for additional staff to service customers & maintain cleanliness.

Despite an initial rush of excitement to visit shops, many customers have learned to use the internet to shop and have got used to it over the last 4 months. This is an acceleration of the underlying growth of internet shopping and gives more customers greater choice to stay away if they have safety concerns and if the experience is not convenient or compelling or does not offer value.

There is a recession looming, predicted to be the worst since WWII. Discretional spending will reduce.

This is a real test for physical retailers who, even pre covid, were feeling the pressure of on-line competition. Businesses that aren’t entirely relevant to customers will find it more challenging to survive.

Even the grocery sector which has experienced a sales uptick of about 20% as they picked up much of the restaurant spending and haven’t needed as many price promotions to secure customers, will find an increasing pressure to discount while still incurring the costs associated with covid safety.

This paints a dark picture, but like all things, it presents an opportunity (albeit an urgent one) for retailers to reimagine and refocus themselves.

New retail standards.

A two pronged strategy is needed to ensure physical store experience is relevant to customers and that commercial performance is optimized.

Relevant to customers

With the deck re-shuffled, here are some of the key themes that we think will influence how customers view physical retailer’s offer:

Community – Prior to covid, about half of shoppers wanted retail to connect them more with their community and 70% wanted retail to be locally differentiated. As four months of lockdown have brought us closer to our community, this trend will have grown. Retailers will need to reflect community on a store basis and on a wider level the creation of locally curated high street destinations will be needed.

Sustainability – Consumer demand for a more sustainable world means retailers will need to embody these values to be credible. 76% of European consumers want retailers to do more to address environmental concerns. Covid has momentarily paused this as everyone buys single use masks and gloves, but this will gain renewed importance.

Experience led – Continuing the trend of retail polarisation, physical retail must define itself by its ability to deliver meaningful experiences not achieved online. Beyond pure physical interaction, trial and the joy of shopping, this includes gamification, education, service and connection with human staff.

Social interaction – Physical retail fulfils the need for a place to socialise. With food and drink or just promenading and shopping together. Of course this needs to be delivered in a safe way that is still meaningful.

Optimise performance

Against the margin squeezing challenges of post covid retail, the following measures are essential “hygiene factors” needed to stay commercially viable:

Covid safety standards – A mandatory requirement to keep customers and staff safe. However rather than a box ticking exercise this should be fully integrated with the store strategy for layout, merchandising, communication and staffing so you reassure customers, maximise footfall, relieve pain points and encourage customers to shop.

Clicks & bricks – Arguably now a basic need, customers expect to shop seamlessly between channels, whether that be click & collect, using the store for returns, or providing transparent value. Stores need to have a fully integrated channel to capture online sales and drive footfall to the shop.

Activating sales – This is about squeezing efficiency from every aspect of your store. Tailoring your range and getting the most profitable category allocation, aligning product location with customer journey and shopping missions to drive consideration, developing effective merchandising and promotional communication to activate sales.

Staff – The post covid role of staff has changed and will likely include greater customer guidance, service and (potentially) sales conversion as well as hygiene tasks.

While you’re here….

Why not take advantage of our FREE post covid health check.

Space 11 are a research and design agency.

We help identify opportunities around, retail offer, category management, in-store experience that improve sales and margin.

We design retail communications, merchandising displays, store layouts and environments that improve retail functionality and make them more relevant places to shop.

We use customer insight & category data combined with planning methodologies built from decades of experience working with retailers and brands.